On this page

- Version 1.0

- Protocol: HTTPS

- Sandbox well-known endpoint: https://sandbox.ob.business.hsbc.com.hk/.well-known/openid-configuration

- Production well-known endpoint: https://api.ob.business.hsbc.com.hk/.well-known/openid-configuration

Introduction

This API provides access to the account information of HSBC HK Business Banking customers.

It supports the following product types:

- Current accounts

- Savings accounts

- Multi-currency accounts

It gives access to the following account information APIs:

- Retrieve account balance API

- Retrieve account transaction API

- Retrieve account availability API

- Retrieve account status API

- Notification event polling API

Version

Change log and release history:

|

Version |

Release Date |

Status |

Description |

|---|---|---|---|

|

V1 |

March 2022 |

Live |

Account Information HK API |

Feedback and Support

Dive in and start coding your applications. If you get stuck or require additional support, please contact our team using the Contact Us form found under the Help menu.

Account Information - HK - Business

Getting started

Welcome to our Open Banking API Sandbox! It enables you to explore all aspects of our Open Banking solution, from registering your app to authorising consent and calling fulfilment APIs.

To get started, you will need to register and login. Once logged in you will need to create a project in our Dev Hub that can be found in the top right of the portal. Creating a project simulates the pre-registration steps you'll need to complete in the live ecosystem and replicates our Dynamic Client Registration (DCR) process. This will register your app on the sandbox and generate your sandbox security credentials.

Once you’ve registered your app, you’ll be able to experiment with our fulfilment APIs including redirection to consent authorisation journeys.

Creating a project

This section will take you through the steps involved in creating a project in the Dev Hub.

1. Create a project - On the Dev Hub landing page, click on the red ‘Create Project’ button.

2. Name your project - On the project information page, enter a name and a short description for your project in the fields provided, then click ‘Continue’.

3. Generate test certificates - Our sandbox only accepts test certificates. Upload your Certificate Signing Request (CSR) and click ‘Continue’ and your test Transport Certificates for Website Authentication (Organisational) and Signing Certificates (Encipherment) will be generated along with a public key and KID. Your test certificates, public key and KID will be available to download/copy from the project details page once you’ve completed project creation.

If you don’t already have a CSR, follow the commands provided to generate a private key and CSR.

Please note - in order to simplify the project creation process, your test Transport and Signing certificates will be generated from the same CSR, however in the production ecosystem you’ll be required to provide different CSRs to generate your Transport and Signing certificates.

4. Generate software statement - On the generate software statement page, enter the details of your app including which Open Banking role(s) it supports and click ‘Continue’.

Please note – The software statement will expire after 1 hour. If you don’t complete project creation before it expires your project will be removed and you’ll need to start the process again. This will also happen if you’re timed out due to inactivity or sign out of develop.hsbc before completing project creation.

5. Sandbox Dynamic Client Registration (DCR) – We recommend that you perform sandbox DCR by completing the final step in the project creation process. Simply enter your auth method (For HSBC HK can only be only private_ket_jwt), click “Complete” and your project details, including ClientID, will be displayed.

Please note – in order to simplify access to the sandbox, registering your app once will enable you to access sandbox APIs for all applicable brands, however in our production environment, you’ll be required to register your app separately for each brand you want to integrate with.

Alternatively, you can perform sandbox DCR directly from your own terminal, using the inputs displayed on the right-hand side of the screen. Refer to the technical documentation of the API for more information regarding DCR.

private_key_jwt

@POST/register_private_key_jwt_curl

Once you’ve successfully completed the process, your new project will be displayed on the sandbox screen. Click on the project card and your project details, including ClientID, will be displayed.

Please note – If you perform sandbox DCR from your own terminal, your project will only be displayed on the sandbox screen once sandbox DCR has been completed successfully i.e. once you’ve been provided with a ClientID. If your project is not displayed, it means that you haven’t performed sandbox DCR successfully and you should try again or complete the process using the guided journey. Remember to complete the process within 1 hour of the software statement being generated otherwise you’ll have to start again.

Please refer to the other sections for information on accessing Dynamic Client Registration and other APIs

Accessing Sandbox APIs

Pre-requisites

- Register on develop.hsbc

- Register an app on the sandbox by creating a project in the Dev Hub

Please refer to the specific API documentation in the portal for information on calling the sandbox APIs, replacing the production base URL with the sandbox base URL.

Customer Consent

Our sandbox access authorisation journeys replicate the function of our production journeys from a TSP’s perspective, in that they enable the customer to select/confirm which account(s) are to be shared, and an authorisation code is provided following successful authentication. However the look and feel of the screens and the steps involved from a customer’s perspective have been standardised in our sandbox across all brands, for the purposes of simplification.

For the purpose of testing please use the test customer security credentials below to authorise the customer consent within the UI.

| Brand | Test Customer User ID | Test Customer Password |

|---|---|---|

| HSBC Business HK | customer00 | 123456 |

On this page

Account Information - HK - Business

On this page

Certificates

Generate Certificate

Onboarding any TSP to Open Banking requires the TSP to acquire the appropriate certificates signed by HK e-cert Post. The TSP shall apply for both organisational and encipherment certificates from HKPost.

There are 2 certificates required:

- Organisational certificate – The Organisational certificate from HK POST is used by the API client for mTLS authentication. It is also known as Client (Transport) Certificate.

- Encipherment certificate - The Encipherment certificate from HK POST is used for signature verification of APIs request data (subject to particular API: query params, request/response body etc.). It is also known as Signing Certificate.

The Signing certificate must be hosted on a publicly accessible URL and follow JWKS standard. This URL endpoint is owned by the TSP and it must be provided in every request from the TSP to HSBC Open Banking Services.

Certificates must be valid and follow x.509 v3 standard. The TSP does not need to upload a public certificate on the Open Banking Platform.

The following is the mapping between subject value and form input:

| Subject value in organisational cert | Form Input |

|---|---|

| CN | User Name on section D of the application form. There are 4 entries means 4 different e-cert. the CN of the 4 difference cert refer to separate entries. Since we have 3 different cert type for organization. CN can map to user name of e-Cert (org) on section D (p.5-6), Unit Name of e-cert (Enc) on section E (p.7) and Server Name on section F (p.8-10) |

| E | Email address of the users on Section D of application form. The email addresses refer to separate entries in section D & section E on difference cert type |

| OU | Company Name as same as BR on section A1 on p.2 of the form |

| OU | BR CI Numbers on section A on p.2 of the form of the TSP

|

| OU | The e-Cert Subscriber Reference Number |

| O | The e-cert Type |

Generate public.jwks

How to extract public JWK from x.509 certificate

The following java program will help you to extract the public key for x.509 Signing Certificate and print it in JWK format.

@private_key_cert

Here is an example of a fully qualified JWKS endpoint content, which contains public JWK used for digital signature validation. Notice you can have multiple JWK entries, and each entry must have a unique KID value within the JWKS.

@private_key_certs

Upload public.jwks

Upload public JWKS file onto web server

Once the JWKS file is generated the TSP shall upload this file to their web server which should be publicly available. The recommendation is to use the TSP's organisational domain e.g. https://tsp-domain.com/your-jwks-path .

TSP embeds kid, certificate and private key in API call

When the TSP makes a call to connect to Open Banking APIs, ensure the following settings are correct:

| Kid | Use the kid from the public JWKS, referring to Encipherment cert record |

| Connectivity certificate | Use Organisational cert and private key |

| Sign JWS Token | Use Encipherment Private Key |

Account Information - HK - Business

TSP Registration

TSPs need to register their client with HSBC's Open Banking platform. In order to achieve this, TSPs need to get their software statement issued first - as per RFC 7591.

To request access to Production APIs, TSPs need to submit a request using the Help, Contact Us form in the portal. Select 'Open Banking APIs - HK - HSBC Business' from the dropdown menu 'Which API does your query relate to?', and then select 'Production Access'.

On receipt of this information the HSBC support team will review the TSPs request and begin the process to on-board the TSP to the Open Banking eco-system. The Software Statement Assertion (SSA) will be securely mailed to the TSP’s registered email address.

TSPs need to check the address of HSBC's registration endpoint using our well-known endpoints available under API Information.

TSP performs dynamic registration:

| Software Statement Sample (Full) | { "software_mode": "Live", "software_environment": "TODO", "software_client_uri": "https://TODO.com", "software_logo_uri": "https://TODO.com", "software_policy_uri": "https://TODO.com", "software_tos_uri": "https://TODO.com", "software_on_behalf_of_org": "https://www.tsp.com", "software_client_description": "software statement for testing purposes", "software_jwks_revoked_endpoint": "https://TODO.com", "software_roles": ["AISP"], "org_jwks_endpoint": "https://TODO.com", "org_status": "Active", "org_contacts": [], "organisation_competent_authority_claims": [], "org_id": "5cb8572403f0df001d", "org_name": "ABC Merchant Ltd.", "org_jwks_revoked_endpoint": "https://TODO.com", "software_client_name": "ABC Merchant Ltd.", "iss": "2fNwVYePN8WqqDFvVf7XMN", "iat": 1556445993, "jti": "45903DAE-3174-4E9E-9047-BBAE9C1A723F", "software_client_id": "2qY9COoAhfMrsH7mCyh86T", "software_redirect_uris": ["https://www.tsp.com/", "https://www.tsp.com/ack"], "software_id": "2qY9COoAhfMrsH7mCyh86T", "software_jwks_endpoint": "https://www.tsp.com/jwks/public.jwks" } |

| Software Statement Sample (Minimal) | { "software_on_behalf_of_org": "https://www.tsp.com", "software_roles": ["AISP"], "org_id": "5cb8572403f0df001d", "org_name": "ABC Merchant Ltd.", "software_client_name": "ABC Merchant Ltd.", "iss": "2fNwVYePN8WqqDFvVf7XMN", "iat": 1556445993, "jti": "45903DAE-3174-4E9E-9047-BBAE9C1A723F", "software_client_id": "2qY9COoAhfMrsH7mCyh86T", "software_redirect_uris": ["https://www.tsp.com/", "https://www.tsp.com/ack"], "software_id": "2qY9COoAhfMrsH7mCyh86T", "software_jwks_endpoint": "https://www.tsp.com/jwks/public.jwks" } |

| Register payload sample | { iss="", "aud": "https://api.ob.hangseng.com", "scope": "openid accounts", "redirect_uris": ["https://www.tsp.com/", "https://www.tsp.com/ack"], "response_types": ["code id_token"], "grant_types": ["authorization_code", "refresh_token", "client_credentials"], "application_type": "mobile", "id_token_signed_response_alg": "PS256", "request_object_signing_alg": "PS256", "token_endpoint_auth_method": "private_key_jwt", "token_endpoint_auth_signing_alg": "PS256", "software_id": "2qY9COoAhfMrsH7mCyh86T", "software_statement": "{Software Statement signed JWT token}", "exp": 1674206304, "iat": 1555506046, "jti": "45903DAE-3174-4E9E-9047-BBAE9C1A723F" } |

Implemented Endpoints:

| Endpoints | Mandatory | Implemented |

|---|---|---|

| POST /register | Conditional | Y |

| GET /register/{ClientId} | Optional | Y |

| PUT /register/{ClientId} | Optional | Y |

Supported authentication methods:

| Method | Supported |

|---|---|

| private_key_jwt | Y |

private_key_jwt

@private_key_jwt

Message signing

x-jws-signature

The iss value from x-jws-signature must match with full DN of HK Post certificate.

On this page

OAuth APIs

Access tokens are used in token-based authentication to enable an authorised TSP to securely access the Open Banking API based on the OAuth 2.0 and the Open ID Connect framework. Access tokens consist of the following grant types – authorisation code, ID token, access token and refresh token.

| Grant Type | Endpoint Specifications |

|---|---|

| Authorisation Code | OIDC Section 3.1 |

| ID Token | OIDC Section 2 |

| Access Token | OIDC Section 3.1.3 |

| Refresh Token | OIDC Section 12 |

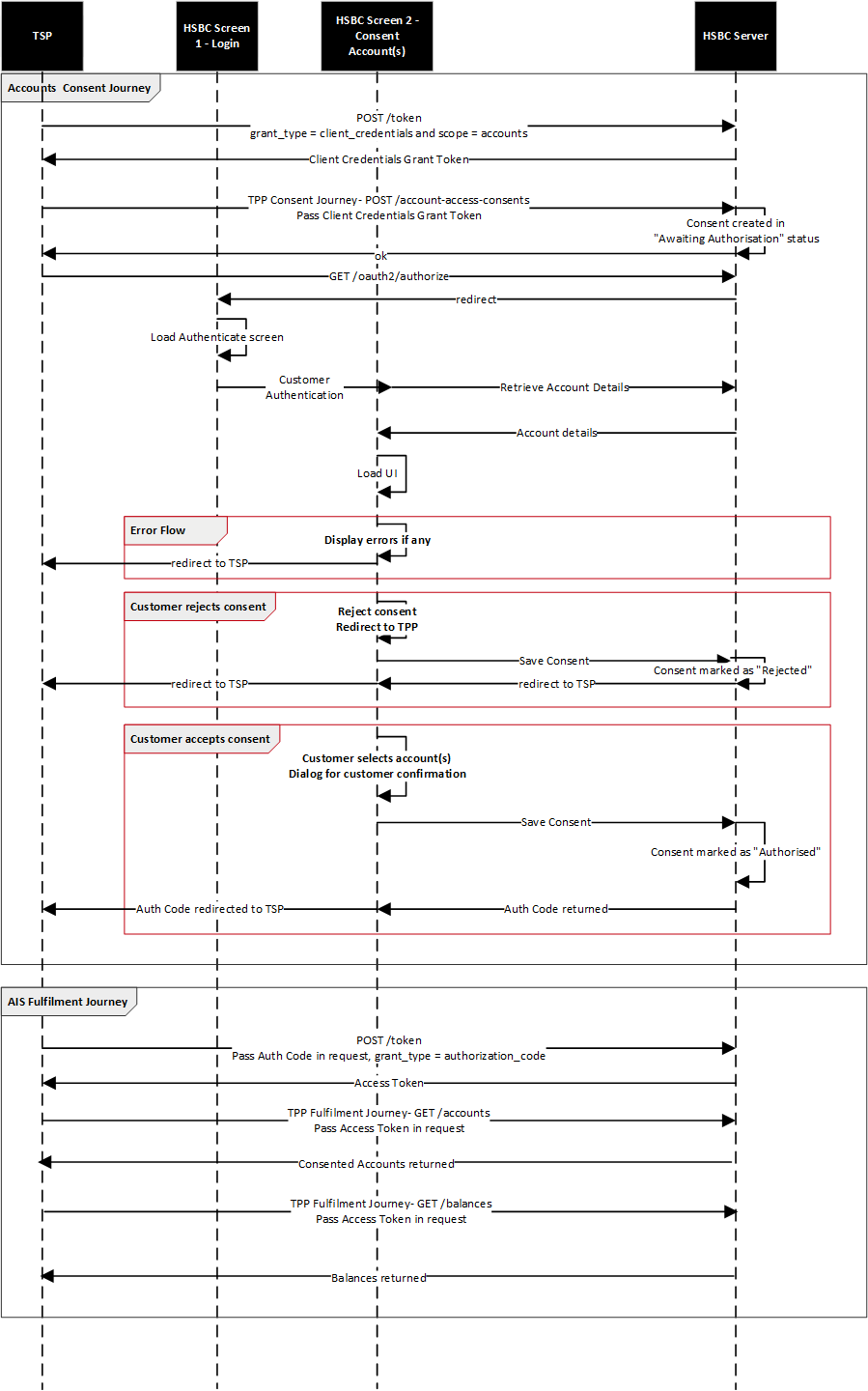

Sequence Flow

Token Expiry

Please see the summary table for token expiry:

| Token | Endpoint | Time To Live |

|---|---|---|

| OAuth Code | POST/customer-auth/confirmation | 2 minutes |

| Access Token | POST/token grant type: client credentials |

5 minutes |

| Access Token | POST/token grant type: authorisation code |

60 minutes - OAuth Code elapsed time |

| Access Token | POST/token grant type: refresh token |

5 minutes |

| Refresh token | POST/token grant type: authorisation code |

AISP 90 days – If consent expiry date is left blank or more than 90 days OR If consent expiry date is provided and less than 90 days the refresh token will only be valid up to the provided date |

Account Information - HK - Business

Customer Consent Management

Summary

The below endpoints are used by TSPs to enable the customer consent management process.

| Endpoint | Function |

|---|---|

| POST /account-consents | Enables the TSP to request the bank to create an account-consents resource. The POST API function is used to create an account-consents resource with consideration given to common API development practice |

| GET /account-consents/{consentId} | Enables the TSP to retrieve account-consents resource |

| DELETE /account-consents/{consentId} | Enables the TSP to perform deletion of account-consents resource |

API Request Headers

| Key | Type | Required | Example Value | Description |

|---|---|---|---|---|

| Content-Type | String | Yes | application/json | This indicates the media type of the resource and the value must be application/json |

| Accept-Language | String | Optional | Standard HTTP header to indicate the natural language set used in the response. Available values : en-HK, zh-HK, zh-CN |

|

| Authorisation | String | Yes | Standard HTTP header that allows credentials to be provided to the authorisation/resource server. Based on the OAuth 2.0/OIDC framework, this consists of basic or bearer authentication schemes | |

| x-fapi-auth-date | String | Optional | Customer last logged-in time with the TSP application. All dates in the HTTP headers are represented as RFC 7231 Full Dates. An example is below: Sun, 10 Sep 2017 19:43:31 UTC | |

| x-fapi-customer-ip-addres | String | Optional | Customer IP address when making a request with the TSP application | |

| x-fapi-interaction-id | String | Optional | Unique correlation ID to playback response for each request |

API Request Parameters

Prepare the request parameters as shown below:

| Key | Type | Required | Example Value | Description |

|---|---|---|---|---|

| consentId | String | Conditional | Unique identifier for consent |

API Request Object

| Name | Definition | Class | Enumeration |

|---|---|---|---|

| permissions | Specifies the Banking Open API account access data types. This is a list of data fields being consented by the customer | ExternalPermissionCode | ReadAccountAvailability ReadAccountStatus ReadAccountBalance ReadAccountTransaction |

| expirationDate | Specified expiration date and time of the permissions (open-ended if blank) | ISODateTime | |

| transactionFromDate | Specified filtering start date and time of the transaction event (open-ended if blank) | ISODateTime | |

| transactionToDate | Specified filtering end date and time of the transaction event (open-ended if blank) | ISODateTime | |

| balanceFromDate | Specified filtering start date and time of the balance event (open-ended if blank) | ISODateTime | |

| balanceToDate | Specified filtering end date and time of the balance event (open-ended if blank) | ISODateTime |

API Response Object

| Name | Definition | Class | Enumeration |

|---|---|---|---|

| permissions | Populated from Request | ExternalPermissionCode | ReadAccountAvailability ReadAccountStatus ReadAccountBalance ReadAccountTransaction |

| expirationDate | Populated from Request | ISODateTime | |

| transactionFromDate | Populated from Request | ISODateTime | |

| transactionToDate | Populated from Request | ISODateTime | |

| balanceFromDate | Populated from Request | ISODateTime | |

| balanceToDate | Populated from Request | ISODateTime | |

| consentId | Unique reference of consent object in the bank | String | |

| status | Specifies the status of consent resource in code form | ConsentStatusCode | PendingAuthorise Rejected Authorised Revoked |

| creationDate | Date and time of consent resource creation | ISODateTime | |

| statusUpdateDate | Date and time of consent status update | ISODateTime |

Errors

| Scenario | HTTP Code | Error Code | Error Description |

|---|---|---|---|

| Input Data Validations - Incorrect permissions | 400 | OB.Field.Invalid | Bad Request - Invalid field |

| Input Data Validations - Invalid date

- ExpirationDateTime - TransactionFromDateTime - TransactionToDateTime - Incorrect field format (Such as, date format is not met pattern, value is outside of enum list, incorrect length, etc) |

400 | OB.Field.Invalid | Bad Request - Invalid field |

| Input Data Validations - Invalid dates

- TransactionFromDateTime - TransactionToDateTime |

400 | OB.Field.InvalidDate |

Bad Request - DateFrom must be before DateTo Bad Request - DateTo must be after DateFrom |

|

- Missing headers - Incorrect headers |

400 | OB.FieldHeader | Bad Request - Missing headers Bad Request - Incorrect headers |

POST /account-consents request

@POST/account-consents request

POST /account-consents response

@POST /account-consents response

Consent Object Statuses

Statuses implemented are in line with the Hong Kong Monetary Authority (HKMA) API Specification.

On top of what is articulated in the HKMA specifications:

- PSU inactivity results in timeout and consent is kept in PendingAuthorise status.

- Web/mobile browser window closure results in keeping the consent in PendingAuthorise status. Intentional actions of the PSU on the HSBC authentication page result in moving the consent to REJECTED status.

- At any point in time a PSU can revoke a consent within HSBC's access dashboard. If this occurs, the consent will have a REVOKED status. If TSPs attempt to access any accounts using the original consent, a 403 FORBIDDEN error will be returned.

Consent Status Definition

PendingAuthorise

- Account-consents resource is initialised and pending for customer authorisation.

Rejected

- Account-consents resource is rejected due to any cancellation or interruption of customer authorisation.

Authorised

- Account-consents resource is successfully authorised; the TSP is allowed to request in-scope customer data before expiry.

Revoked

- Account-consents resource is revoked due to customer consent revocation request.

Account Status

Summary

The below endpoints are used by TSPs to retrieve consented accounts for a customer.

Retrieve Accounts API

| Endpoint | Mandatory/ Optional | Function |

|---|---|---|

| GET /accounts | Mandatory | Enables the TSP to retrieve a list of account information in bulk, including account status |

API Request Headers

| Key | Type | Required | Example Value | Description |

|---|---|---|---|---|

| Accept-Language | String | Optional | Standard HTTP header to indicate the natural language set used in the response. Available values : en-HK, zh-HK, zh-CN |

|

| Authorisation | String | Yes | Standard HTTP header that allows credentials to be provided to the authorisation/resource server. Based on the OAuth 2.0/OIDC framework, this consists of basic or bearer authentication schemes | |

| x-fapi-auth-date | String | Optional | Customer last logged-in time with the TSP application. All dates in the HTTP headers are represented as RFC 7231 Full Dates. An example is below: Sun, 10 Sep 2017 19:43:31 UTC | |

| x-fapi-customer-ip-addres | String | Optional | Customer IP address when making a request with the TSP application | |

| x-fapi-interaction-id | String | Optional | Unique correlation ID to playback response for each request |

Response

| Name | Definition | Mandatory/ Optional | Class | Examples |

|---|---|---|---|---|

| accountId | Specifies the unique identifier used internally by Data Provider to identify an account | Mandatory | String | 201137243039306132394A5553778B |

| accountNumber | Specifies the account number assigned by Data Provider to identify an account | Mandatory | String | 01XXXXX188 |

| accountType | Specifies the type of account | Mandatory | AccountTypeCode | Business |

| accountSubType | Specifies the sub type of account | Mandatory | AccountSubTypeCode | Savings, Current |

| productName | Specifies the name of the product | Mandatory | String | Zero Balance Savings |

| accountStatus | Specifies the status of account | Mandatory | AccountStatus | Active, Inactive |

| currency | Specifies the account currency code | Mandatory | ISOCurrencyCode | HKD, RMB, USD |

Errors

| Scenario | TSP Facing HTTP Code | TSP Facing Error Code | Error Description |

|---|---|---|---|

| The TSP tries to access an account resource but the TSP does not have a consent authorisation for the AccountId e.g. an attempt to access GET /accounts/2001 when the PSU has not selected AccountId 2001 for authorisation | 403 | NA | Forbidden |

| HSBC Server Errors | 500 | OB.UnexpectedError /OB.InternalError | |

| Invalid request Invalid account number Invalid currency |

400 | OB.InternalError |

GET /accounts request

@GET /accounts request

GET /accounts response

@GET /accounts response

Account Balance

Summary

Account Balance is a synchronous enquiry API that retrieves the following Account Balances:

Intraday: real time ledger balance and real time available balance

Historical: day end ledger balance

The fromDate and toDate request parameters can be added to support a historical balance query. The Request and Response format is in JSON. Up to 200 accounts can be returned in a single request.

Retrieve Account Balance API

| Endpoint | Function |

|---|---|

| GET /accounts/{accountId}/balances | Enables Data Requestor to retrieve account balance for specific Account ID |

API Request Headers

Prepare the request parameters as shown below:

| Key | Type | Required | Example Value | Description |

|---|---|---|---|---|

| Accept-Language | String | Optional | Standard HTTP header to indicate the natural language set used in the response. Available values : en-HK, zh-HK, zh-CN |

|

| Authorisation | String | Yes | Standard HTTP header that allows credentials to be provided to the authorisation/resource server. Based on the OAuth 2.0/OIDC framework, this consists of basic or bearer authentication schemes | |

| x-fapi-auth-date | String | Optional | Customer last logged-in time with the TSP application. All dates in the HTTP headers are represented as RFC 7231 Full Dates. An example is below: Sun, 10 Sep 2017 19:43:31 UTC | |

| x-fapi-customer-ip-addres | String | Optional | Customer IP address when making a request with the TSP application | |

| x-fapi-interaction-id | String | Optional | Unique correlation ID to playback response for each request | |

| accountId | String | Mandatory | Unique identifier for account | |

| fromDate | String | Optional | Specifies the start date time for filtering out the transactions date; a blank value will be treated open-ended. Time zone input will be ignored. Date format i.e. 2017-10-22 | |

| toDate | String | Optional | Specifies the end date time for filtering out the transactions date; a blank value will be treated as open-ended. Time zone input will be ignored. Date format i.e. 2017-10-22 |

API Request Parameters

Prepare the request parameters as shown below:

| Key | Type | Required | Example Value | Description |

|---|---|---|---|---|

| accountId | String | Conditional | Unique identifier for account | |

| fromDate | String | Optional | Specifies the start date time for filtering out the transactions date; a blank value will be treated open-ended. Time zone input will be ignored. Date format i.e. 2017-10-22 | |

| toDate | String | Optional | Specifies the end date time for filtering out the transactions date; a blank value will be treated as open-ended. Time zone input will be ignored. Date format i.e. 2017-10-22 |

API Response Object

| Name | Definition | Class | Examples |

|---|---|---|---|

| accountId | Specifies the unique identifier used internally by the bank to identify an account | String | 201137243039306132394A5553778B |

| balance | Specifies the balance object of the account | BalanceData | |

| type | Specifies the type of account balance | BalanceTypeCode |

ledgerBalance, availableBalance, dayEndLedgerBalance |

| creditDebitIndicator | Specifies whether the account balance is a credit or debit balance | CreditDebitCode | Credit, Debit |

| amount | Specifies the account balance amount | String | 10000.25 |

| currency | Specifies the account currency code | ISOCurrencyCode | HKD, RMB, USD |

| datetime | Specifies the date and time of the account balance | ISODateTime | 2020-12-22T07:06:20Z |

Errors

| Scenario | TSP Facing HTTP Code | TSP Facing Error Code | TSP Facing Causes | Error Description |

|---|---|---|---|---|

| The TSP tries to access an account resource but the TSP does not have a consent authorisation for the AccountId. e.g., an attempt to access GET/accounts/2001/balance when the PSU has not selected AccountId 2001 for authorisation. | 403 | NA | Forbidden | |

| Balances From and To Date Validation failure: fromDate > toDate | 400 | OB.Field.InvalidDate | DateTo must be after DateFrom | DateTo must be after DateFrom |

| Balances From and To Dates are in Invalid format | 400 | OB.Field.InvalidDateFormat | Invalid date format | Invalid date value |

| Date Range exceeds specific range | 400 | OB.Field.InvalidDateRange | invalid date range | 1 year (365 days) |

| HSBC Server Errors | 500 | OB.UnexpectedError | Unexpected Error |

API Request Body

Account balances can be requested individually per account, or in a multi-account request of up to 50 accounts.

Example request body:

@Example request body

Example response payload:

@Example response payload

Account Transaction(s)

Account Transaction(s) is a synchronous enquiry API that retrieves the current day or historical date transactions. Request and Response format is JSON. The API request provides the transactions for a single account per API call. Each transaction enquiry call returns up to 200 transactions in single API response, additional transactions can be retrieved via subsequent calls using the next link, i.e. via pagination. Transactions can be retrieved in ascending order (oldest first) or descending order (latest first).

Retrieve Account Transaction API

| Endpoint | Function |

|---|---|

| GET /accounts/{accountId}/transactions | Enables Data Requestor to retrieve account transactions for specific Account ID |

API Request Headers

| Key | Type | Required | Example Value | Description |

|---|---|---|---|---|

| Accept-Language | String | Optional | Standard HTTP header to indicate the natural language set used in the response. Available values : en-HK, zh-HK, zh-CN |

|

| Authorisation | String | Yes | Standard HTTP header that allows credentials to be provided to the authorisation/resource server. Based on the OAuth 2.0/OIDC framework, this consists of basic or bearer authentication schemes | |

| x-fapi-auth-date | String | Optional | Customer last logged-in time with the TSP application. All dates in the HTTP headers are represented as RFC 7231 Full Dates. An example is below: Sun, 10 Sep 2017 19:43:31 UTC | |

| x-fapi-customer-ip-addres | String | Optional | Customer IP address when making a request with the TSP application | |

| x-fapi-interaction-id | String | Optional | Unique correlation ID to playback response for each request |

API Request Parameters

| Query Parameter | Definition | Mandatory/ Optional | Class | Examples |

|---|---|---|---|---|

| accountId | Unique identifier for account | Mandatory | String | |

| fromDate | Specifies the start date time for filtering out of the transactions date, blank value will be treated as open end. Time Zone input will be ignored | Optional | ISODateTime |

2020-12-22T07:06:20Z |

| toDate | Specifies the end date time for filtering out of the transactions date, blank value will be treated as open end. Time Zone input will be ignored | Optional | ISODateTime | 2020-12-22T07:06:20Z |

Response

Data Dictionary – AccountTransactionData

| Name | Definition | Mandatory/ Optional | Class | Examples |

|---|---|---|---|---|

| accountId | Specifies the unique identifier used internally by Data Provider to identify an account | Mandatory | String | 201137243039306132394A5553778B |

| accountNumber | Specifies the account number assigned by Data Provider to identify an account | Mandatory | String | XXXXXXXXXX02 |

| transactionId | Specifies the unique identifier for the transaction used by the Data Provider | Mandatory | String | MBKFT42508230004073 |

| transactionDescription | Specifies the description of transaction | Mandatory | String | Bill Payment |

| transactionDate | Specifies the date and time of the transaction. posted |

Mandatory | ISODateTime | 2020-12-22T07:06:20Z |

| creditDebitIndicator | Specifies whether the transaction is a credit or debit entry | Mandatory | CreditDebitCode | Credit Debit |

| status | Specifies the status of the transaction entry | Mandatory | TransactionStatusCode | Pending Booked |

| amount | Specifies the transaction amount | Mandatory | String | 10079.36 |

| currency | Specifies the account currency code | Mandatory | ISOCurrencyCode | HKD, RMB, USD |

Errors

| Scenario | TSP Facing HTTP Code | TSP Facing Error Code | Error Description |

|---|---|---|---|

| Transaction From and To Date Validations. When FromDate > toDate. | 400 | OB.Field.InvalidDate | DateTo must be after DateFrom |

| Transaction From and To Dates are in Invalid format. When Format of the date is not in ISOdatetime | 400 | OB.Field.InvalidDate | Invalid date value |

| The TSP tries to access an account/balance resource and the TSP does not have a consent authorisation for the AccountId. e.g., an attempt to access GET /accounts/2001 or GET /accounts/2001/transaction when the PSU has not selected AccountId 2001 for authorisation | 403 | NA | Forbidden |

| Request query params: Date Range exceeds specific range of 1 year | 400 | OB.InvalidDateRange | invalid date range. |

| Request query param: Transaction From Date is future date | 400 | OB.InvalidDate | DateFrom is Future date |

| Request query param: Transaction To Date is future date | 400 | OB.InvalidDate | DateTo is Future date |

| HSBC Server Errors | 500 | OB.InternalError | Internal Server Error |

GET /accounts/transactions request sample

@GET /accounts/transactions HTTP/1.1

GET /accounts/transactions response sample

@x-fapi-interaction-id

Account Availability

Summary

This API is used by the TSP to verify customer information for those customers that have granted consent, in order for the TSP to conduct KYC for customer.

Retrieve Account Availability API

| Endpoint | Mandatory/ Optional | Function |

|---|---|---|

| POST /accounts/availability | Mandatory | Enables the TSP to check customer information against the specific account and return account availability status |

API Request Headers

| Key | Type | Required | Example Value | Description |

|---|---|---|---|---|

| Content-Type | String | Yes | application/json | This indicates the media type of the resource and the value must be application/json |

| Accept-Language | String | Optional | Standard HTTP header to indicate the natural language set used in the response. Available values : en-HK, zh-HK, zh-CN |

|

| Authorisation | String | Yes | Standard HTTP header that allows credentials to be provided to the authorisation/resource server. Based on the OAuth 2.0/OIDC framework, this consists of basic or bearer authentication schemes | |

| x-fapi-auth-date | String | Optional | Customer last logged-in time with the TSP application. All dates in the HTTP headers are represented as RFC 7231 Full Dates. An example is below: Sun, 10 Sep 2017 19:43:31 UTC | |

| x-fapi-customer-ip-addres | String | Optional | Customer IP address when making a request with the TSP application | |

| x-fapi-interaction-id | String | Optional | Unique correlation ID to playback response for each request |

Response

Commercial Banking

| Name | Definition | Mandatory/ Optional | Class | Examples |

|---|---|---|---|---|

| paramName | Specifies the parameter name to verify the available customer and account-type information | Mandatory | String |

accountNumber businessRegistrationCertificate certificateOfIncorporation other HSBC accepts maximum three params |

| paramValue | Specifies the parameter value against the parameter type |

Mandatory | String |

HK AccountNumber

businessRegistrationCertificate: P00022 certificateOfIncorporation: P00030 other: A000001 |

| status | Specifies the status of the account availability for the requested parameter | Mandatory | String |

Yes, No, Error |

Errors

| Error Description | HTTP Status | Error Code | Error Description |

|---|---|---|---|

| When consent is invalid | 403 | 403 | Forbidden |

| When account number sent in the request is invalid | 403 | 403 | Forbidden |

| Field validation failure - businessRegistrationCertificate - certificateOfIncorporation - other - accountNumber |

400 | OB.InvalidRequestParams | Invalid paramName |

| There are more than 3 paramNames in the request | 400 | OB.UnexpectedParamsNo | Maximum number of paramNames is 3 |

| paramName requested is duplicated. The same pair of values | 400 | OB.ParamsDuplicated | Duplicated requested paramName |

| HSBC Server Errors | 400 | OB.MissingAccountNumber | paramName doesn't have 'accountNumber |

| HSBC Server Errors | 500 | OB.InternalError | Internal Server Error |

POST /accounts/availability request

@POST /accounts/availability request

POST /accounts/availability response

@POST /accounts/availability response

Event Polling

Summary

Event polling is a mechanism for the bank server to create a notification event when resources change in the bank domain, and to provide notification of the resource change to the TSP using the Open Banking API.

| Endpoint | Function |

|---|---|

| POST /events | Enables the TSP to get outstanding notification events from the bank and to send event acknowledgement to the bank |

API Request Headers

| Key | Type | Required | Example Value | Description |

|---|---|---|---|---|

| Content-Type | String | Yes | application/json | This indicates the media type of the resource and the value must be application/json |

| Accept-Language | String | Optional | Standard HTTP header to indicate the natural language set used in the response. Available values : en-HK, zh-HK, zh-CN |

|

| Authorisation | String | Yes | Standard HTTP header that allows credentials to be provided to the authorisation/resource server. Based on the OAuth 2.0/OIDC framework, this consists of basic or bearer authentication schemes | |

| x-fapi-auth-date | String | Optional | Customer last logged-in time with the TSP application. All dates in the HTTP headers are represented as RFC 7231 Full Dates. An example is below: Sun, 10 Sep 2017 19:43:31 UTC | |

| x-fapi-customer-ip-addres | String | Optional | Customer IP address when making a request with the TSP application | |

| x-fapi-interaction-id | String | Optional | Unique correlation ID to playback response for each request |

API Request Object

| Name | Type | Required | Example Value | Description |

|---|---|---|---|---|

| ack | String | Optional | “4d3559ec67504aaba65d40b0363faad8” | List of successfully handled “jti” |

| returnImmediately | Boolean | Mandatory | true, false |

Optional JSON Boolean value that indicates the SET transmitter should return an immediate response even if no results are available (short polling) |

| maxEvents | Integer | Mandatory | 20 | Size limit for the event collection size in the response, null or zero input for the field indicates the bank returned an empty set of outstanding events |

API Response Object

| Name | Description | Class | Enumeration |

|---|---|---|---|

| sets | JSON object containing zero or more SETs being returned. Each member name is the "jti" of a SET to be delivered, and its value is a JSON string representing the corresponding SET. If there are no outstanding SETs to be transmitted, the JSON object shall be empty. Note that both SETs being transmitted for the first time and SETs that are being retransmitted after not having been acknowledged are communicated here. | String | N/A |

Error

| Scenario | HTTP Code | Error Code | Error Description |

|---|---|---|---|

|

Input Data Validations - "maxEvents" is greater than 10 |

400 |

OB.Field.Invalid |

maxEvents is not within the limits allowed by ASPSP |

|

Input Data Validations - "returnImmediately" = false |

400 |

OB.Field.Invalid |

Invalid field |

|

Input Data Validations - without maxEvents blocker |

400 |

OB.FieldHeader |

Bad Request - Missing headers Bad Request - Incorrect headers |

|

[Pool and acknowledge] Validation - return an error when querying 'POST /events' with 1 mismatched ack |

400 |

OB.Unexpectederror |

Jti in the request are not valid |

|

[Pool and acknowledge] Validate - return an error when querying "POST /events" with 2 mismatched ack |

400 |

OB.Unexpectederror |

Jti in the request are not valid |

|

[Pool and acknowledge] Validate - return an error when querying "POST /events" with 2 mismatched ack |

400 |

OB.Unexpectederror |

Jti in the request are not valid |

POST /events request

@POST /events request

POST /events response

@POST /events response