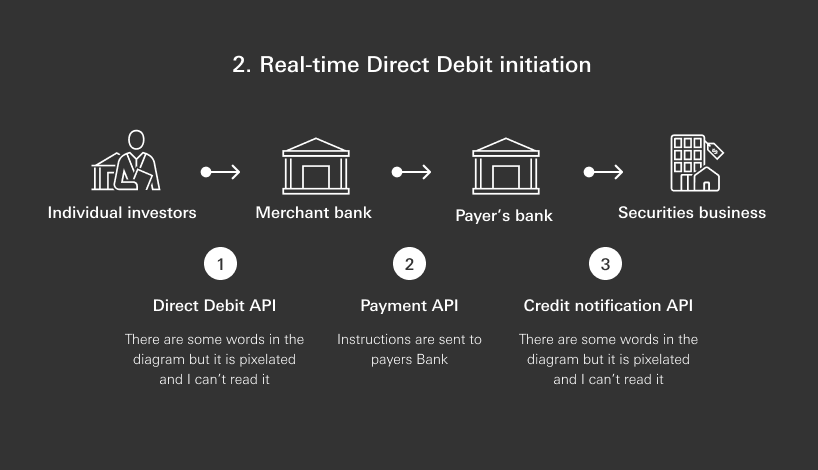

Innovative real-time Direct Debit solutions use collection APIs that allow investors - through one click on a single platform - to fund their trading accounts instantly with a verified source of funds.

Instant funding of investment accounts enables the investor to execute trades immediately following account setup, providing a better client experience.Instant funding of investment accounts enables the investor to execute trades immediately following account setup, providing a better client experience.

Speed up your investors’ experiences with instant top-ups

Challenges

Keeping pace with transaction speeds

The speed of opening and funding of online trading accounts is increasingly important as investors typically wish to immediately transact to take advantage of market opportunities.

Slow manual processes

Previously, the direct debit process was manual and paper-intensive, and often took 6 to 12 weeks to complete. Investors also had to log on to multiple platforms to initiate payments to fund their trading accounts on the moomoo app, which were limited to banking hours.

Hard to reconcile payments

In addition, manual checks and reconciliation of investor details against source of funds significantly slowed down the funding process, leading to increased costs and a suboptimal investor experience.

Examples

Simplify customer experience

Customer navigates to their invoice payment screen in their preferred ERP, TMS or Accounting Platform

Customer selects one or multiple invoices to pay

The payment api creates the payment instruction message, connects to HSBC and returns a response

Disclaimer: This demo is for illustration purposes only

API Catalogue

Find the right API for you

Benefits

Onboard faster

Seamless onboarding, account opening and funds transfer for the underlying investors

Reduce errors

Straight-through-processing rate, reducing payment errors and rejections

Eliminate manual reconciliation

With instant notifications, it reduces the need for manual reconciliation