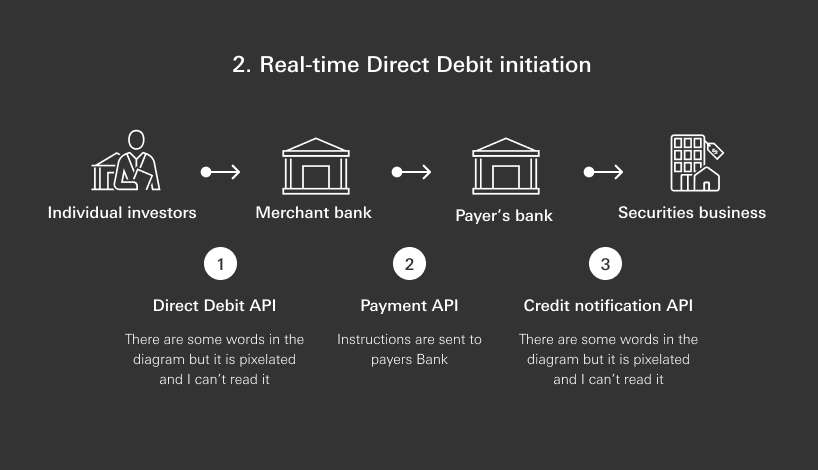

Innovative real-time Direct Debit solutions use collection APIs that allow investors - through one click on single platform - to fund their trading accounts instantly with a verified source of funds.

Instant funding to investment accounts enables the investor to execute trades immediately following account setup, providing a better client experience. Instant funding of investment accounts enables the investor to execute trades immediately following account setup, providing a better client experience.